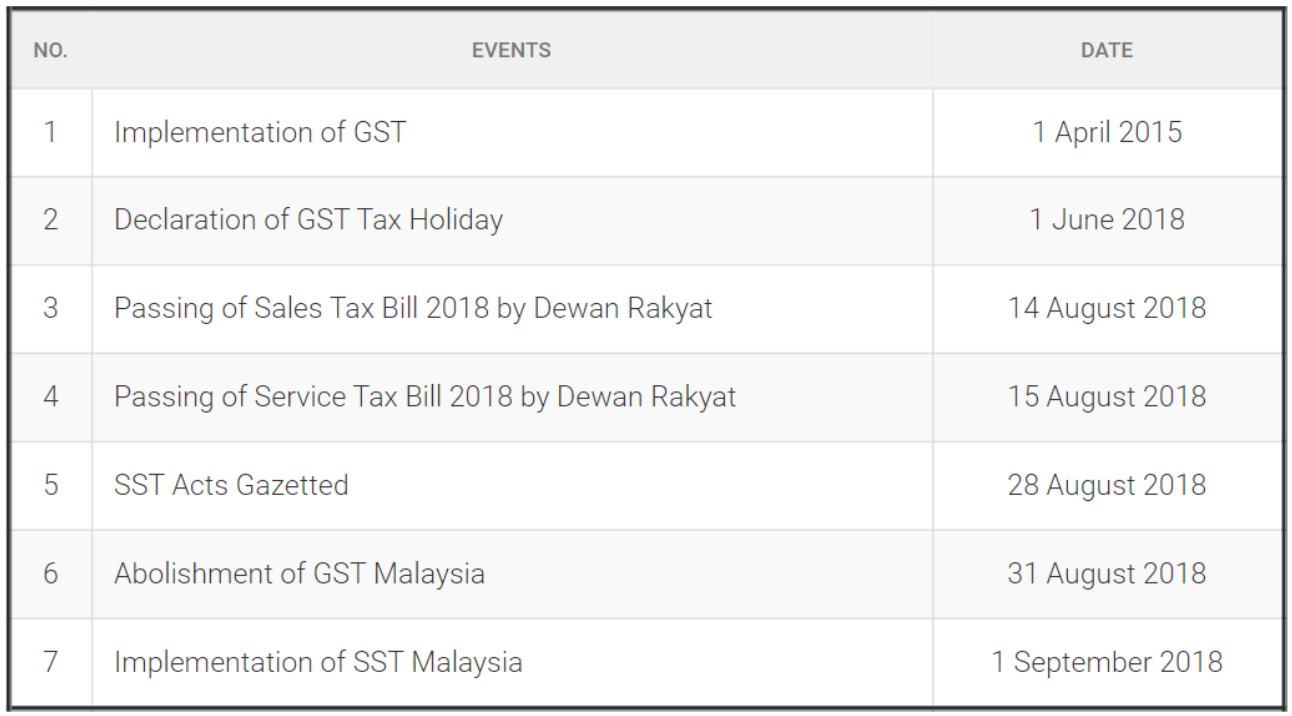

On 16 July 2018 the Minister of Finance announced that SST will be introduced with effect from 1 September 2018. O Payment of SST has to be made Electronically.

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Okay the 3 Impacts of SST to Malaysians In general there are 3 notable impacts the public and businesses will feel from the change of GST to SST in Malaysia.

. Sales tax a single-stage tax. Also since the SST implementation is supposed to keep things affordable for low-income groups. Originally scheduled to end on December 31 that year the SST exemption was extended at the last moment to June 30 2021 and then again to December 31 2021.

Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018. Even the sale of motorcycles is proposed to be free of the Sales Tax. Until then a transitional arrangement will be in place to help.

Sales and Service Tax commonly known as SST is the new tax in Malaysia that was implemented on 1 September 2018. In accordance to the announcement made by the Malaysian Government on the implementation of Sales and Service Tax Act 2018 effective 1 Sept 2018 the Sales and Service Tax SST will. It replaced the Goods and Services Tax GST which was.

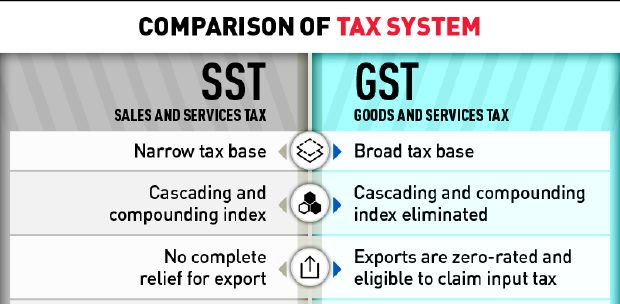

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1. It has been reported that businesses in Malaysia have spent almost RM15 billion to implement GST systems that have been in use for less than four years8. A single stage tax levied on imported and locally manufactured goods either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

Overview of Service Tax 3 Implementation date 1st September 2018 Self-assessment system Scope of tax Provision of service in Malaysia Provision or sale of goods by selected business. GST Implementation in Malaysia. The most commonly discussed worries among Malaysias citizens is whether this change of Tax system through the replacement of GST with SST would cause an increase in.

The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in. The Malaysian government has replaced its former tax system of SST the Sales and Service Tax with the new GST Goods and Service Tax system to. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

The introduction of GST is part of the Governments tax reform program. Implemented since September 2018 Sales and Service Tax SST has replaced Goods and Services Tax GST in Malaysia. Back in May Malaysian Automotive Association MAA president Datuk Aishah Ahmad also hinted that prices of automobiles may see an increase following the.

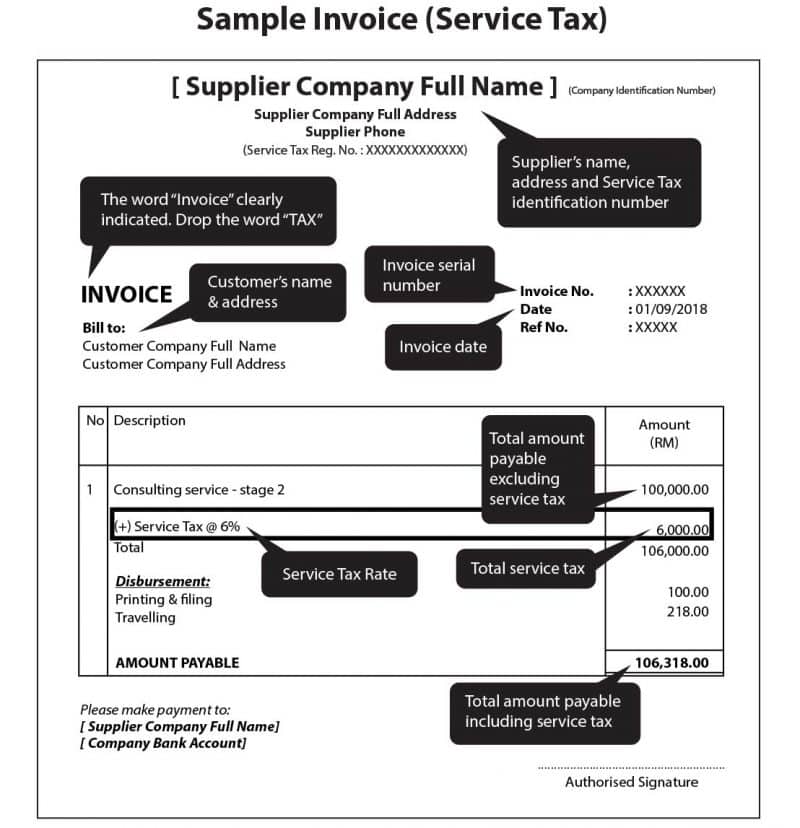

This website is developed to enable the public to access information related to the Royal Malaysian Customs Department includes corporate information organization and Customs. The proposed rate of service tax 6. The SST consists of 2 elements.

Service tax is imposed on specific prescribed services provided by a taxable person in the course or furtherance of a business in Malaysia. O Late payment penalty on the amount of sales tax not paid 10 - first 30. GST in Malaysia is proposed to replace the current consumption tax ie.

The sales tax and service tax SST. Or By cheque bank draft and posted to SST Processing Centre. Following the announcement the Royal Malaysian Customs.

Thus to increase the government revenue Goods Services Tax GST was implemented in Malaysia starting from April 2015 to replace the Sales and Services Tax SST.

Gst Better Than Sst Say Experts

Malaysia Sst Sales And Service Tax A Complete Guide

Pdf Public Acceptance And Compliance On Goods And Services Tax Gst Implementation A Case Study Of Malaysia Semantic Scholar

Prices Unchanged At Guardian Malaysia In September After Sst Implementation Pamper My

Gst Better Than Sst Say Experts

Why The Gst Became Malaysia S Public Enemy Number One The Diplomat

![]()

Notification On Sales And Services Tax Sst Implementation Modernlms Elearning Malaysia Digital Learning Platform Made And Supported In Malaysia Lms Malaysia

Impact Of Sst On Consumers In Malaysia Money Compass

Malaysian Taxation The Tasks Ahead For Sst Asia Research News

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Sst Vs Gst How Do They Work Expatgo

Teo Yee Trading Added A New Photo Teo Yee Trading

Sst 2 0 A Simpler Tax For Businesses The Edge Markets

No Delay In Sst Implementation Says Guan Eng The Star

Kia Malaysia Sdn Bhd Officially Announces New Pricing Of Its Model Range Post Sst News And Reviews On Malaysian Cars Motorcycles And Automotive Lifestyle

Sst Vs Gst Here Are 5 Things That You Need To Know

Ways To Pay For Sales And Services Tax Sst In Malaysia An Overview

%20ENGLISH.jpg)